April 4, 2018

Keeping Your Tax Records

Share this article...

When it comes to your taxes, good records are the best protection you can have if the government decides to audit your returns. But just as important as your effective recordkeeping are the measures you take to make certain that your records are kept safe. While it may cause a chuckle to picture a mythical taxpayer confessing to an IRS auditor that tax records were destroyed by the family pet, it probably wouldn’t be nearly as funny to give a similar response in a real audit of your own.

The Advantage of Good Records

A good set of records can help you cut your taxes. Detailed records reduce the chance that you will overlook deductible expenses when your tax return is prepared. After all, how many people remember the exact details of their expenditures months after the fact? Nothing is more frustrating than knowing you incurred deductions yet not being able to prove them. The ultimate consequence of poor recordkeeping is enforced payment of more tax than the law requires.

Explicit records provide the best assurance of a favorable outcome if you are audited. Oral testimony alone is seldom enough to prove the deductions you claim on your tax return – auditors want to see a paper trail of receipts, logs, etc.

When you’re missing adequate backup records, it can cost a great deal in time and effort to get duplicates. The unfortunate fact is that many businesses balk at hunting down receipts for past sales (you can’t really blame them since it raises their expenses). Your ongoing recordkeeping effort is your best remedy to counteract this problem.

Good records help others who might have to handle your financial affairs in an emergency – e.g., an illness. The better your records are, the easier it could be for someone else to temporarily “step into your shoes” to handle your monetary transactions.

Tracking Income

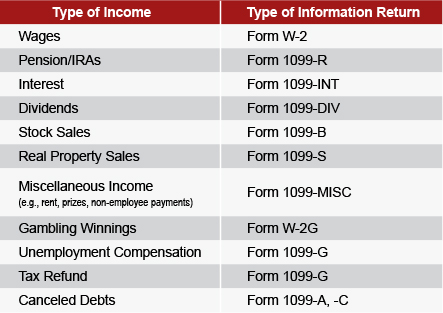

How you track your income is largely dependent on the type of income you are receiving. For certain kinds of income, you will receive statements from the income payers to tell you the amount. These statements are called “information returns” by the IRS. Examples include:

When you receive an information return, you should compare it to your own records, and if there is a discrepancy in the amount of income reported, you should determine whether your records or the payer’s are in error. If you find your records are accurate, contact the payer to issue a corrected information return or explain to you how they determined the amount they have reported. Be sure to keep information returns you receive in a safe place so that the amounts reported on them can be shown accurately on your tax return. Payers must submit the data to the government as well as to you. The IRS will compare what they have received with your return to see that your reporting and their data match. If there’s a mismatch, you will get a letter asking ‘Why?’ or assessing additional tax. Since the IRS may misinterpret return reporting, check carefully before paying any extra tax they try to assess!

Income From Other Sources

Income not traceable to information returns also needs to be reported on your tax return. It could include such items as:

Getting Organized

No one method is the only way to maintain your records. What’s important is to develop a system that is the most convenient and comprehensive for your situation, and then to stick to it. The IRS estimates that a non-business taxpayer who files a 1040 return will spend about eight hours doing recordkeeping. For a more complex return, such as one with rental properties or self-employment income, add at least another five hours. The following suggestions may help you organize your records, and also reduce the time you spend doing so.

Decide first if you will maintain your records manually or by computer.

Knowing When to Discard Records

Taxpayers often question how long records must be kept and how long the IRS has to audit a return after it is filed. ANSWER: It all depends on the circumstances! In many cases, the federal statute of limitations can be used to help you determine how long to keep records. With certain exceptions, the statute for assessing additional tax is three years from the return due date or the date the return was filed, whichever is later. However, the statute of limitations for many states is one year longer than the federal.

The reason for this is that the IRS provides state taxing authorities with federal audit results. The extra time on the state statute gives states adequate time to assess tax based on any federal tax adjustments.

In addition to lengthened state statutes clouding the recordkeeping issue, the federal three-year rule has a number of exceptions:

Examples: Sue filed her 2016 tax return before the due date of April 15, 2017. She will be able to safely dispose of most of her records after April 15, 2020. On the other hand, Don filed his 2016 return on June 2, 2017. He needs to keep his records at least until June 2, 2020. In both cases, the taxpayers may opt to keep their records a year or two longer if their states have a statute of limitations longer than three years. Note: If a due date falls on a Saturday, Sunday or holiday, the due date becomes the next business day.

Important note: Even if you discard backup records, never throw away your file copy of any tax return (including W-2s). Often, the return itself provides data that can be used in future return calculations or to prove amounts related to property transactions, social security benefits, etc.

Records to Keep Longer Than Three Years

You should keep certain records for longer than three years. These records include:

The Advantage of Good Records

A good set of records can help you cut your taxes. Detailed records reduce the chance that you will overlook deductible expenses when your tax return is prepared. After all, how many people remember the exact details of their expenditures months after the fact? Nothing is more frustrating than knowing you incurred deductions yet not being able to prove them. The ultimate consequence of poor recordkeeping is enforced payment of more tax than the law requires.

Explicit records provide the best assurance of a favorable outcome if you are audited. Oral testimony alone is seldom enough to prove the deductions you claim on your tax return – auditors want to see a paper trail of receipts, logs, etc.

When you’re missing adequate backup records, it can cost a great deal in time and effort to get duplicates. The unfortunate fact is that many businesses balk at hunting down receipts for past sales (you can’t really blame them since it raises their expenses). Your ongoing recordkeeping effort is your best remedy to counteract this problem.

Good records help others who might have to handle your financial affairs in an emergency – e.g., an illness. The better your records are, the easier it could be for someone else to temporarily “step into your shoes” to handle your monetary transactions.

Tracking Income

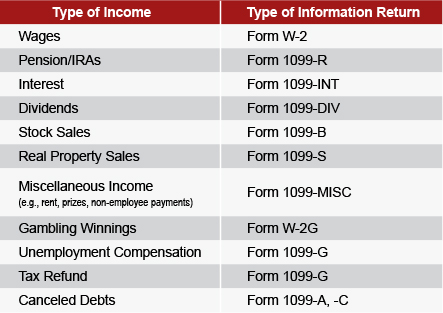

How you track your income is largely dependent on the type of income you are receiving. For certain kinds of income, you will receive statements from the income payers to tell you the amount. These statements are called “information returns” by the IRS. Examples include:

When you receive an information return, you should compare it to your own records, and if there is a discrepancy in the amount of income reported, you should determine whether your records or the payer’s are in error. If you find your records are accurate, contact the payer to issue a corrected information return or explain to you how they determined the amount they have reported. Be sure to keep information returns you receive in a safe place so that the amounts reported on them can be shown accurately on your tax return. Payers must submit the data to the government as well as to you. The IRS will compare what they have received with your return to see that your reporting and their data match. If there’s a mismatch, you will get a letter asking ‘Why?’ or assessing additional tax. Since the IRS may misinterpret return reporting, check carefully before paying any extra tax they try to assess!

Income From Other Sources

Income not traceable to information returns also needs to be reported on your tax return. It could include such items as:

- Receipts from a self-employed business;

- Rental income;

- Interest income on a personal loan.

Getting Organized

No one method is the only way to maintain your records. What’s important is to develop a system that is the most convenient and comprehensive for your situation, and then to stick to it. The IRS estimates that a non-business taxpayer who files a 1040 return will spend about eight hours doing recordkeeping. For a more complex return, such as one with rental properties or self-employment income, add at least another five hours. The following suggestions may help you organize your records, and also reduce the time you spend doing so.

Decide first if you will maintain your records manually or by computer.

- Bookkeeping software - Some taxpayers, even though they aren’t operating a business, choose computerized “bookkeeping” software that uses their check register data to track their income and expenses by category. Monthly and yearly reports conveniently recap the income and expenses, especially if the accounts (income and expense categories) are consistent with how the information is reported for tax purposes.

- Spreadsheet method – In lieu of purchasing bookkeeping software, a spreadsheet file (for example, in Excel) may be set up where you record your yearly income and expenses by tax return category. If you normally itemize your deductions, set up a separate sheet for each of the major deduction categories –medical, taxes, contributions, etc. – as found on Schedule A. For medical expenses, for example, record each expense by provider’s name, type, date, amount paid, and payment method. Note medically related auto mileage at the same time. At year’s end, sort income and expenses of the same type together to get a yearly total. For income items, a cross-check from the spreadsheet to the 1099 forms for all bank interest or other income sources is an accurate way to verify that all needed 1099s have been received. If your tax advisor gives you a “tax organizer” to help you prepare for your appointment, you can quickly transfer the totals from your spreadsheet to the organizer, or, instead, you can provide your advisor with a copy of the spreadsheet.

- Manual lists – If you keep track of your records manually, the same type of system applies as for a spreadsheet, except you’ll set up a paper sheet for each category of income and expense that you normally have on your tax return. Write each payment you receive or expense you incur on the applicable list. At the end of the year, each list is ready to be totaled. If you make your entries no less frequently than monthly, you’ll find that the overall time you spend will be less, and the accuracy of the information will be greater, than if you wait until just before your tax appointment to put together the year’s lists.

- Envelopes – Using several blank envelopes, write the tax year and names of the income and expense categories that correspond to your spreadsheet or manual list of accounts. After you’ve recorded an item on your list, insert the corresponding receipt, canceled check, etc., into the envelope. By storing the source documents by category throughout the year, instead of throwing all of them in a box to get to “later,” you’ll not only save time but considerable frustration if you must search for a particular item. There is also less likelihood that a receipt or other document will be lost. Store the envelopes in a larger master envelope or box.

- File Folders – Some taxpayers prefer to use file folders labeled by income and expense categories. These work well for manually maintained records, as the lists can go right in the folders along with the substantiating receipts, checks, credit card slips, etc. Small-sized receipts should be taped or stapled to a letter-sized sheet of paper to prevent them from falling out of the folder.

- Binders – A binder, set up with dividers labeled by income and expense categories, is also useful for keeping your lists and paper records. three-hole plastic sheet protectors are convenient for keeping source documents together by category in the binder(s). Binders are especially useful for filing monthly or quarterly brokerage or bank account statements.

Knowing When to Discard Records

Taxpayers often question how long records must be kept and how long the IRS has to audit a return after it is filed. ANSWER: It all depends on the circumstances! In many cases, the federal statute of limitations can be used to help you determine how long to keep records. With certain exceptions, the statute for assessing additional tax is three years from the return due date or the date the return was filed, whichever is later. However, the statute of limitations for many states is one year longer than the federal.

The reason for this is that the IRS provides state taxing authorities with federal audit results. The extra time on the state statute gives states adequate time to assess tax based on any federal tax adjustments.

In addition to lengthened state statutes clouding the recordkeeping issue, the federal three-year rule has a number of exceptions:

- The assessment period is extended to six years instead of three if a taxpayer omits from gross income an amount that is more than 25 percent of the income reported on a tax return.

- The IRS can assess additional tax with no time limit if a taxpayer: (a) doesn’t file a return; (b) files a false or fraudulent return in order to evade tax; or (c) deliberately tries to evade tax in any other manner.

- The IRS gets an unlimited time to assess additional tax when a taxpayer files an unsigned return.

Examples: Sue filed her 2016 tax return before the due date of April 15, 2017. She will be able to safely dispose of most of her records after April 15, 2020. On the other hand, Don filed his 2016 return on June 2, 2017. He needs to keep his records at least until June 2, 2020. In both cases, the taxpayers may opt to keep their records a year or two longer if their states have a statute of limitations longer than three years. Note: If a due date falls on a Saturday, Sunday or holiday, the due date becomes the next business day.

Important note: Even if you discard backup records, never throw away your file copy of any tax return (including W-2s). Often, the return itself provides data that can be used in future return calculations or to prove amounts related to property transactions, social security benefits, etc.

Records to Keep Longer Than Three Years

You should keep certain records for longer than three years. These records include:

- Stock acquisition data. If you own stock in a corporation, keep the purchase records for at least four years after the year you sell the stock. This data will be needed in order to prove the amount of profit (or loss) you had on the sale.

- Stock and mutual fund statements where you reinvest dividends. Many taxpayers use the dividends they receive from a stock or mutual fund to buy more shares of the same stock or fund. The reinvested amounts add to basis in the property and reduce gain when it is finally sold. Keep statements at least four years after final sale.

- Tangible property purchase and improvement records. Keep records of home, investment, rental property, or business property acquisitions AND related capital improvements for at least four years after the underlying property is sold.

Printable PDF